Condo Insurance in and around Bloomfield

Get your Bloomfield condo insured right here!

Condo insurance that helps you check all the boxes

Condo Sweet Condo Starts With State Farm

Are you investing in condo ownership for the first time? Or have you been a condo owner before? Either way, it can be a good idea to get coverage for your condominium with State Farm's Condo Unitowners Insurance.

Get your Bloomfield condo insured right here!

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

With this insurance from State Farm, you don't have to be afraid of the unforeseen happening to your biggest asset. Agent Diane Smith can help provide all the various options for you to consider, and will assist you in building a wonderful policy that's right for you.

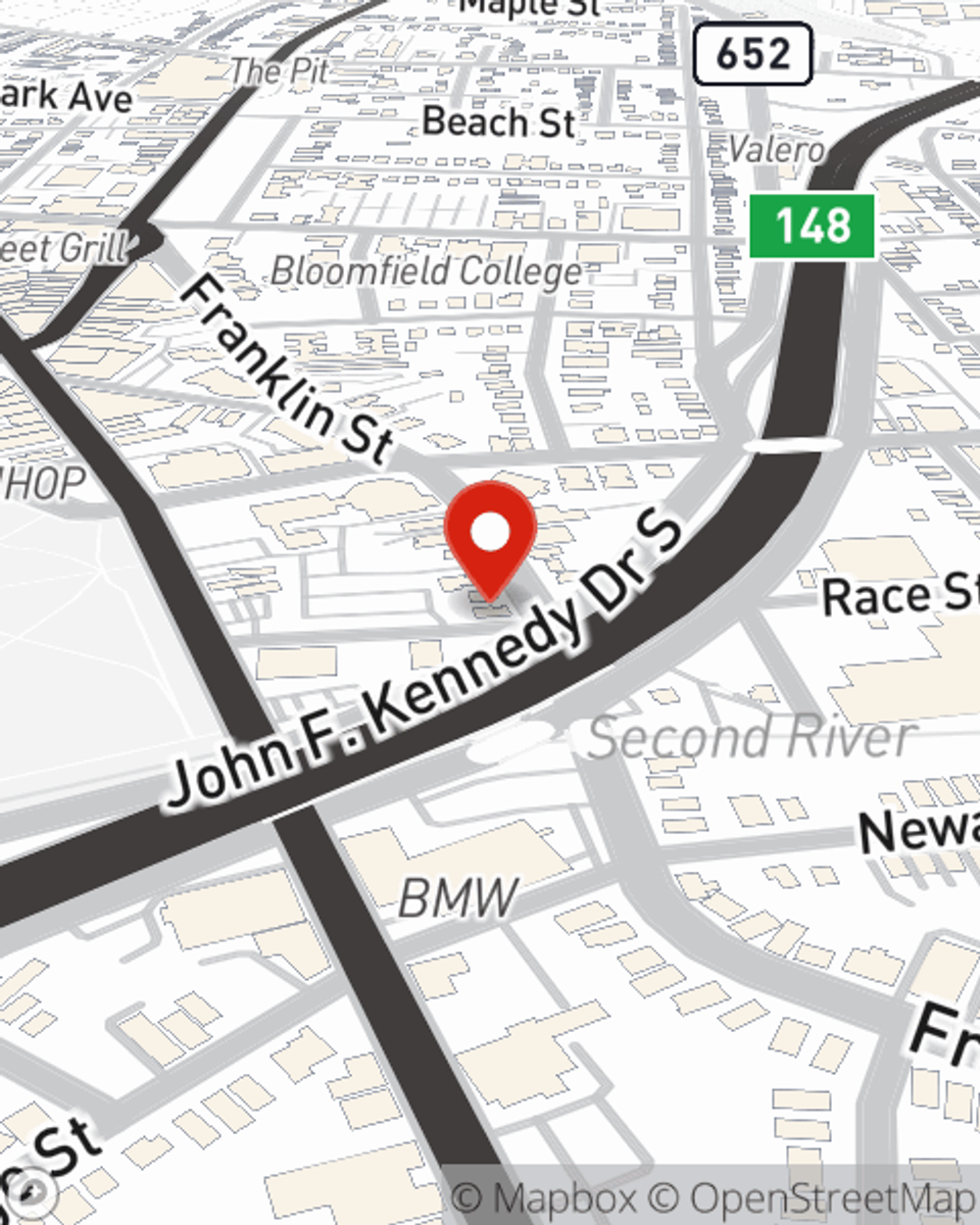

Getting started on an insurance policy for your condo is just a quote away. Stop by State Farm agent Diane Smith's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call Diane at (973) 337-8507 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Diane Smith

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.